– Traditional Finances

Financial Transparency Summary

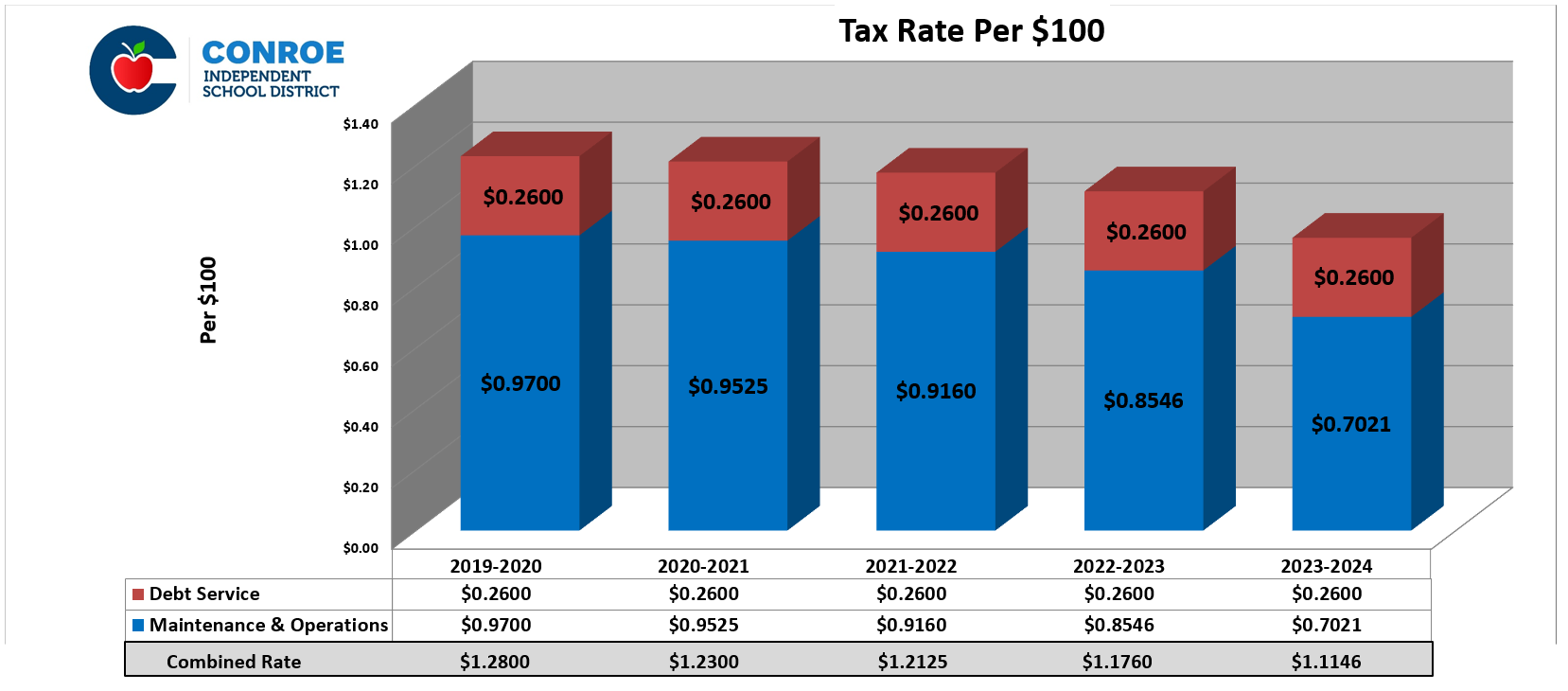

Tax Rate Information

The Districts property tax rate is made up of a Maintenance & Operations tax rate and a Debt Service tax rate. As its name suggests, the Maintenance & Operations tax rate provides funds for the maintenance and operations costs of the school district. The Debt Service tax rate provides funds for payments on the debt that finances the districts facilities.

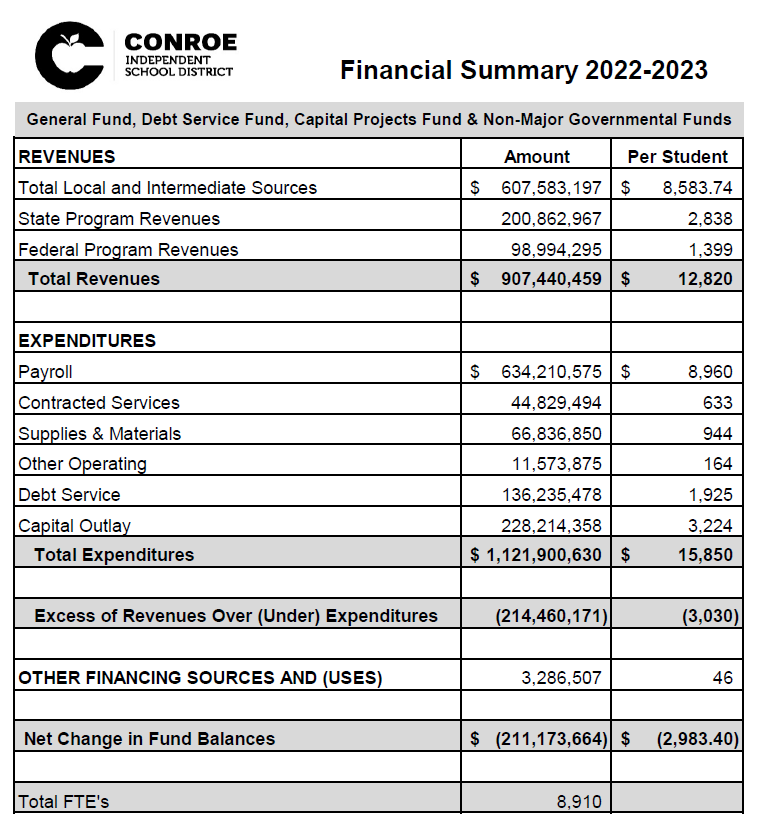

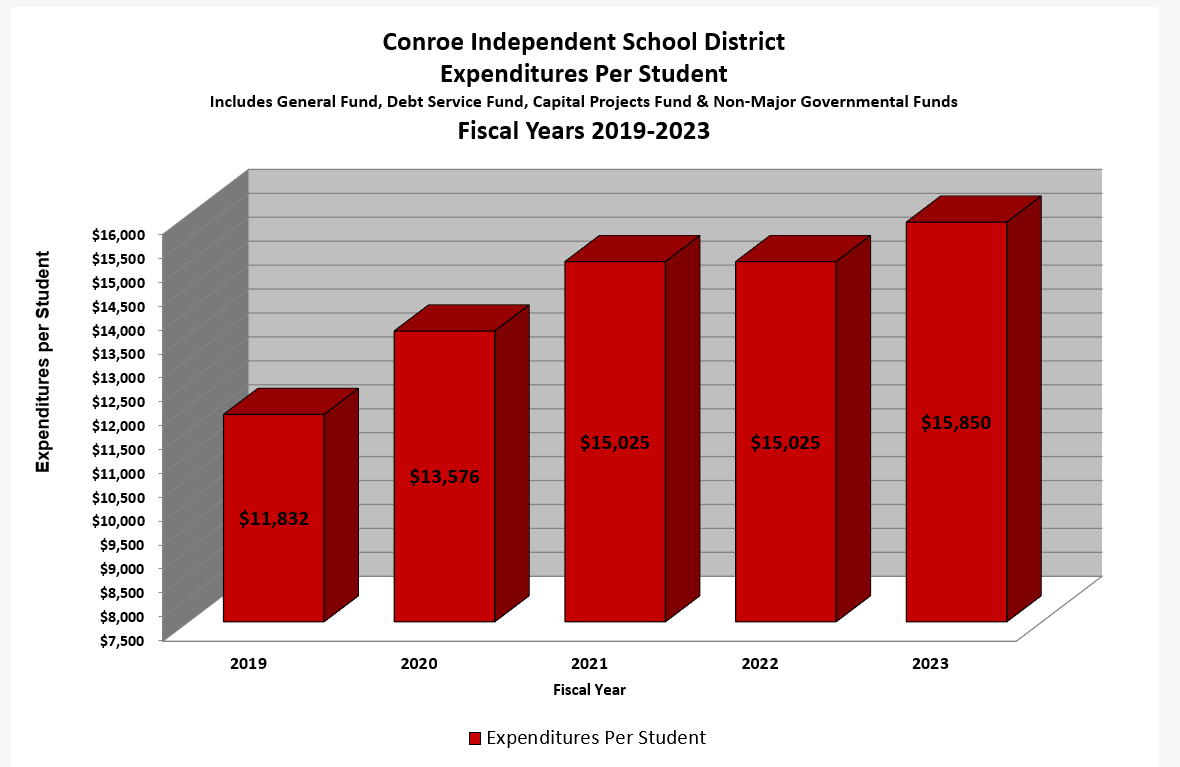

Expenditures Per Student

Expenditures per student are calculated using audited financial statement data for all funds (General Fund, Debt Service Fund, Capital Projects Fund & Non-Major Governmental Funds).

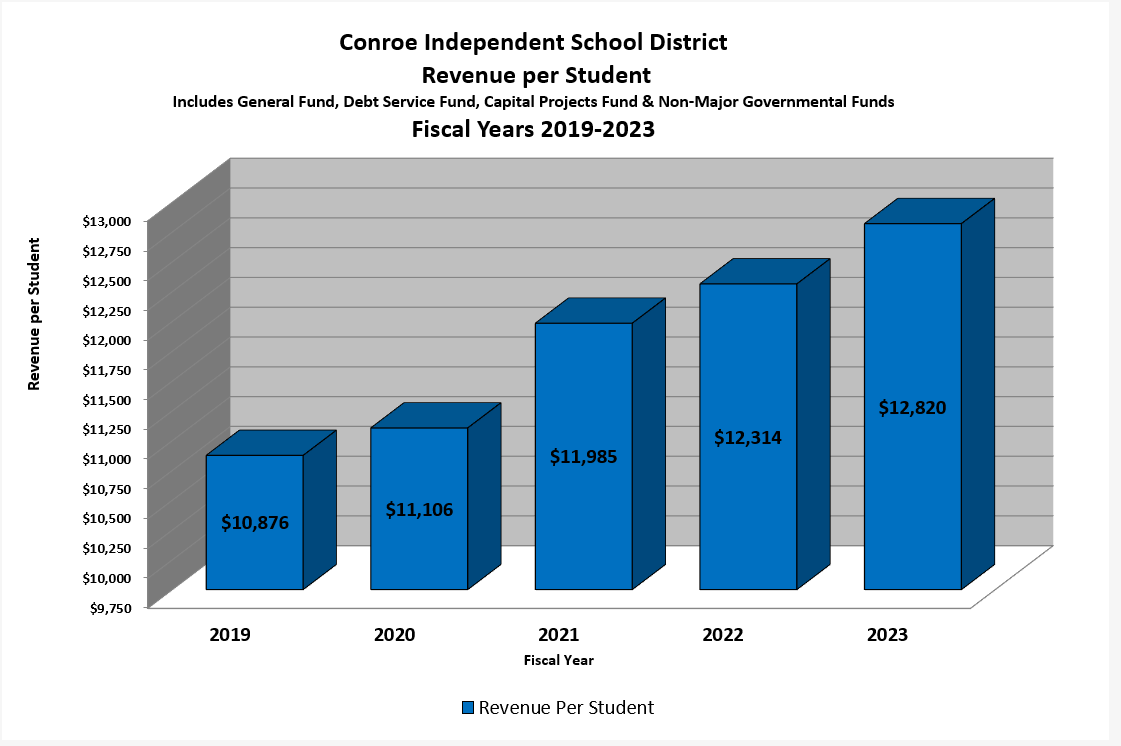

Revenue Per Student

Revenue per student is calculated using audited financial statement data for all funds (General Fund, Debt Service Fund, Capital Projects Fund & Non-Major Governmental Funds).

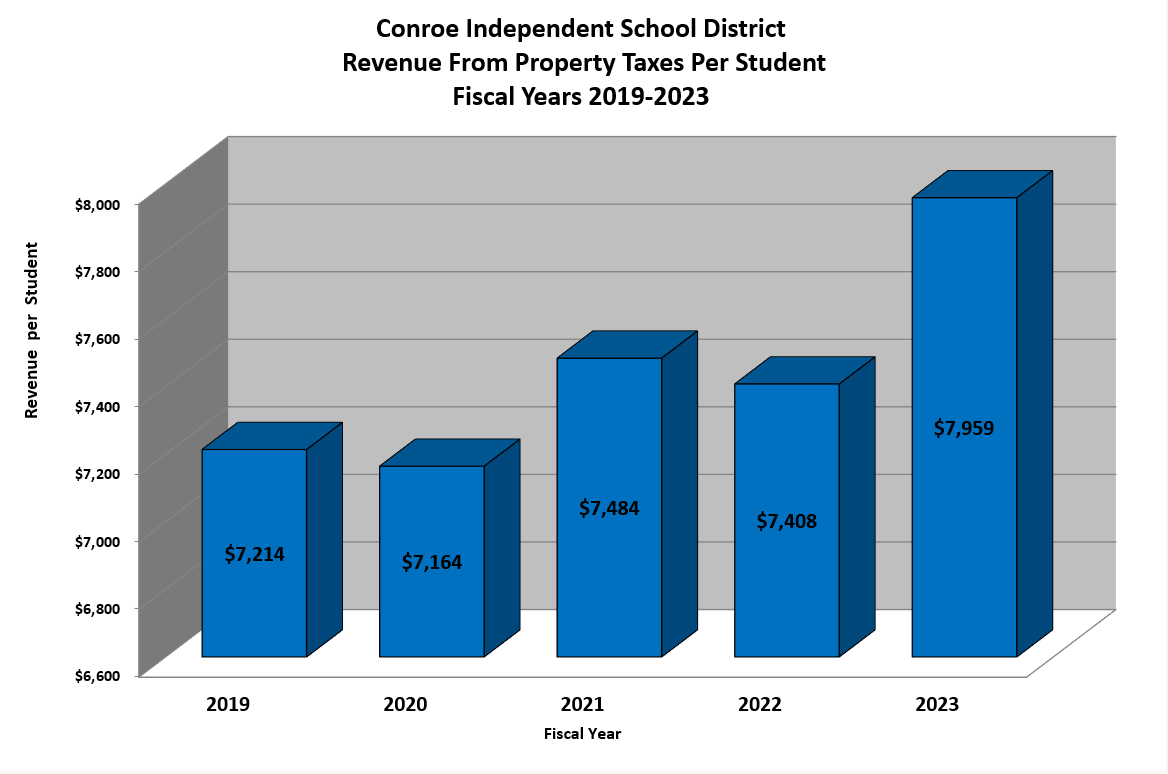

Property Tax Revenue Per Student

Property tax revenue includes property tax collections, penalties, interest & other tax related income. The district has no sales tax revenue.

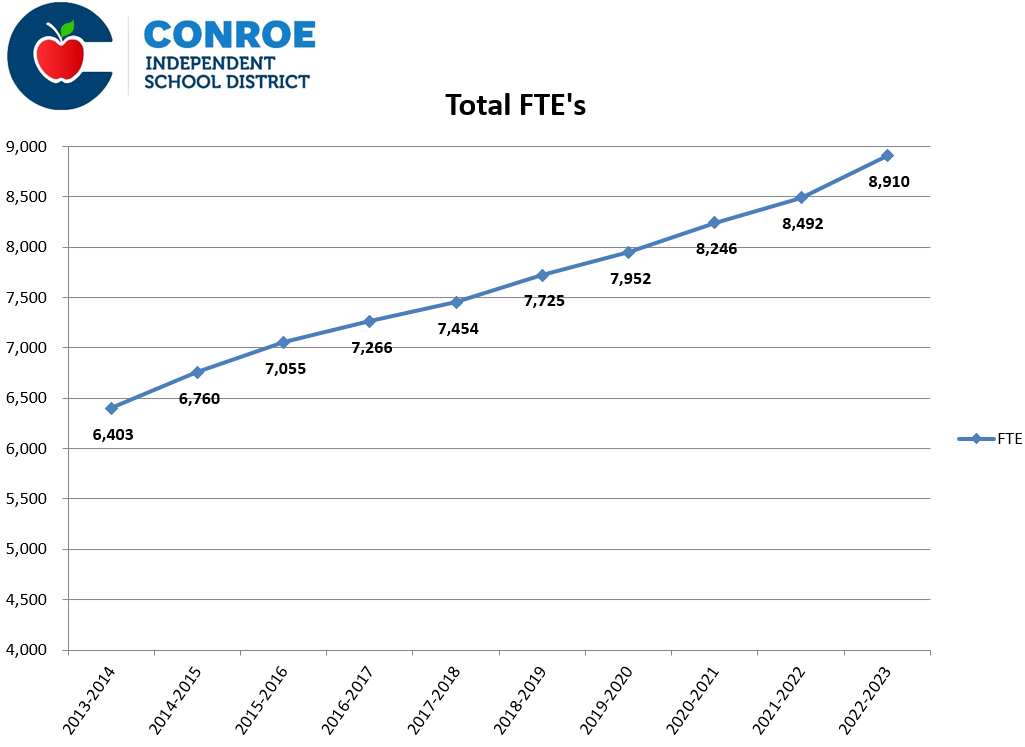

Full Time Equivalent Personnel

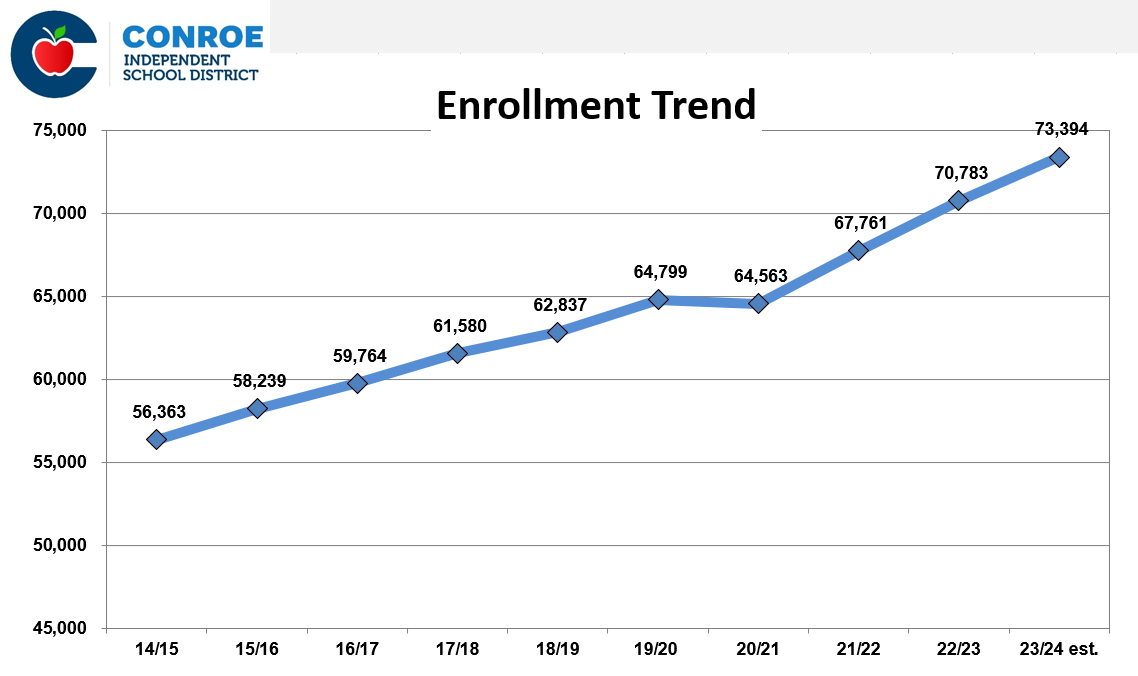

Enrollment Trend

Budget Infomation

Click side menu to display budget information