– Debt Obligations

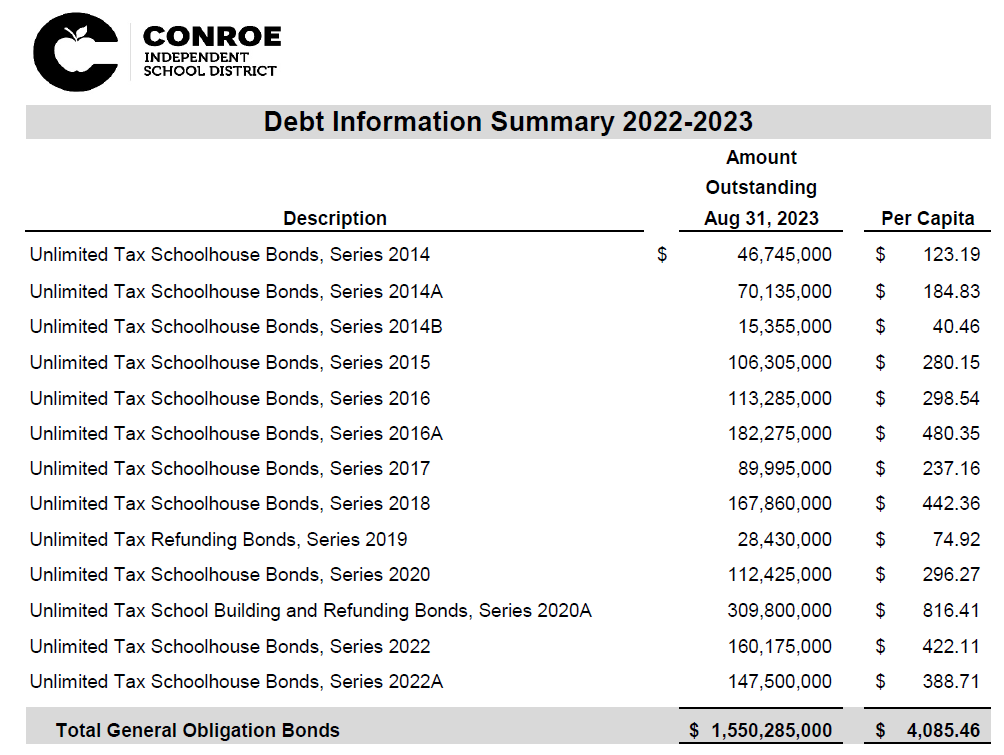

Debt Transparency Summary

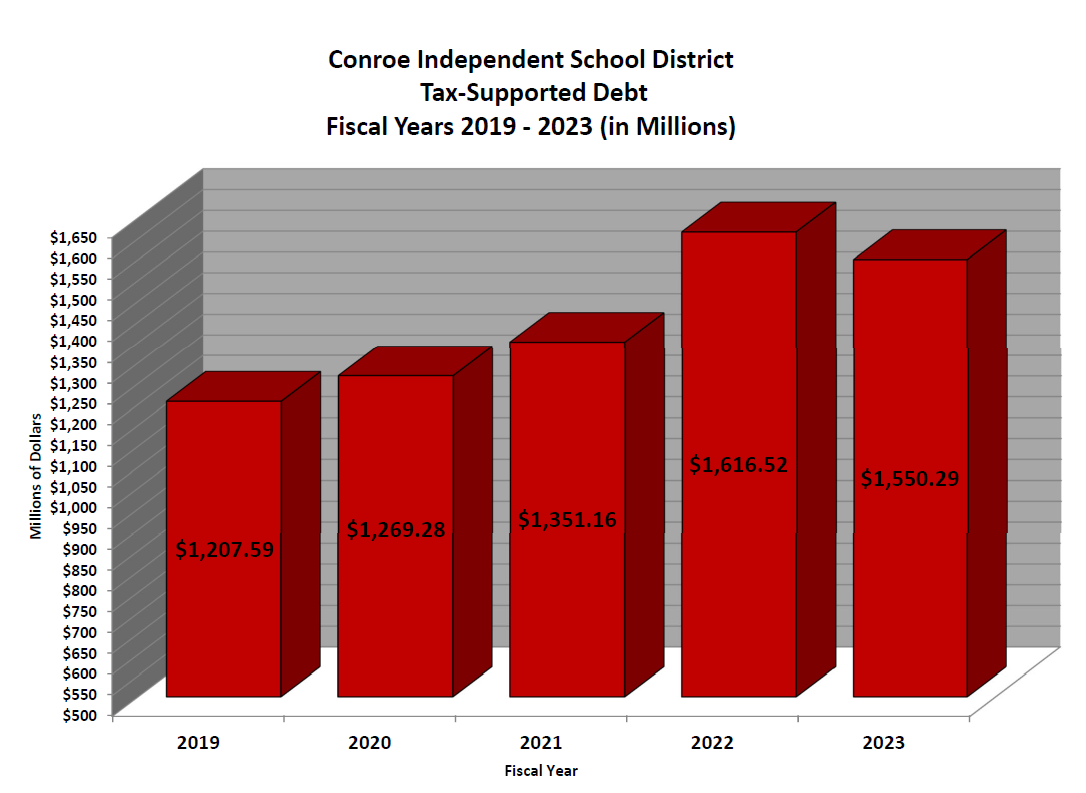

Total Tax Supported Debt

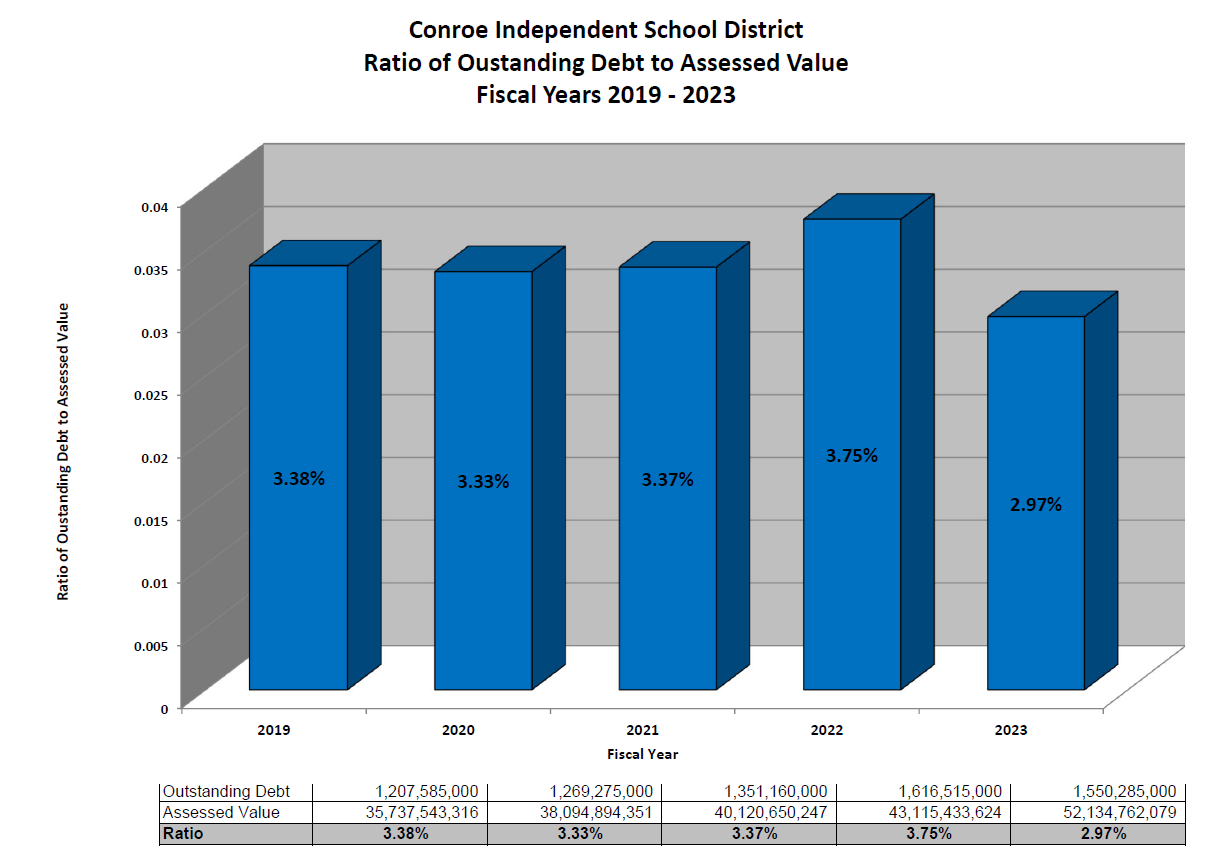

Outstanding debt is presented as of fiscal year end August 31.

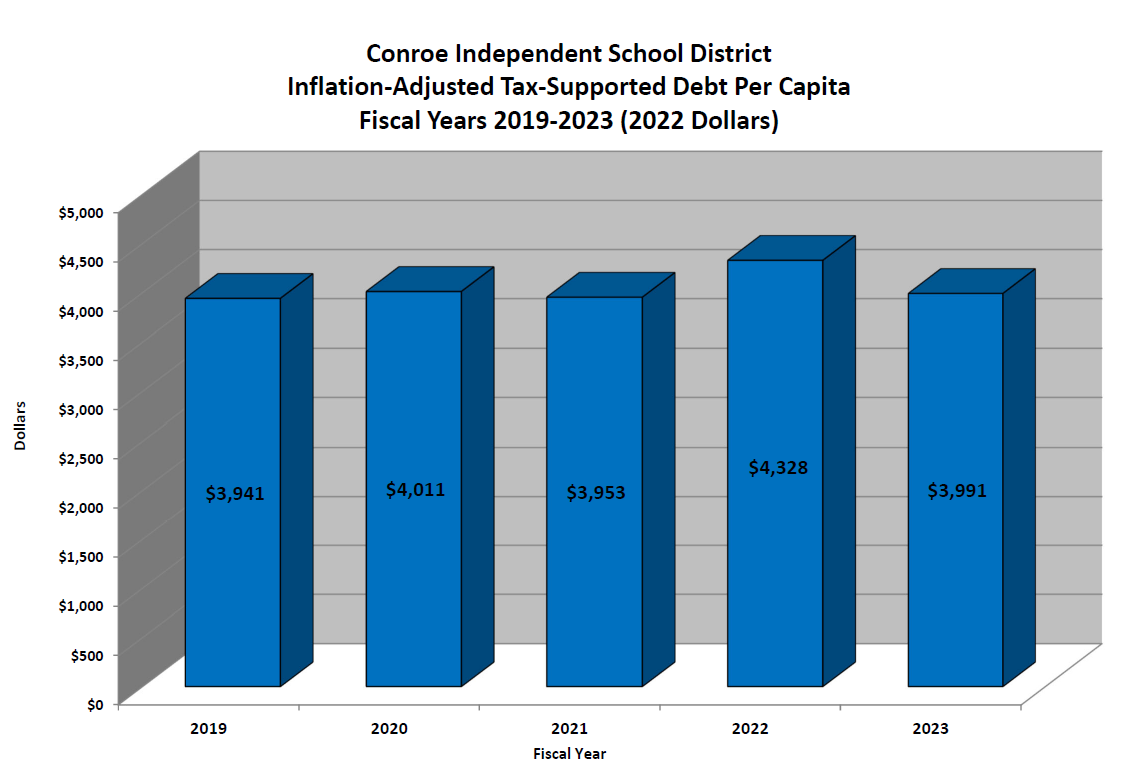

Debt Per Capita

Debt per capita is calculated using population estimates provided by The Municipal Advisory Council of Texas (TMR Report).

Ratio of Outstanding Debt to Assessed Value

Tax Rate Information

The Districts property tax rate is made up of a Maintenance & Operations tax rate and a Debt Service tax rate. As its name suggests, the Maintenance & Operations tax rate provides funds for the maintenance and operations costs of the school district. The Debt Service tax rate provides funds for payments on the debt that finances the districts facilities.

Bond Referendum

More detailed information about the District’s most recent bond referendum can be found at the link below:

Bond Election History